This credit card uses the Mastercard network and is accepted everywhere Mastercard is accepted. The MyFortiva Mastercard credit card is a secured credit card that might help you build credit. It does not provide any welcome bonuses, cash back, or other sorts of perks since it is solely a card for establishing credit.

Or

MyFortiva Retail Credit uses its own unique models, backed by more than 20 years in the lending industry. The FICO score is an extract from these models, but not the whole. By leveraging their proprietary trust models, they can offer record-keeping to customers who have been ignored or rejected by multiple lenders. Fortiva Retail Credit allows sellers to offer revolving credit extensions for a significant APR. Interest is amortized over two years.

MyFortiva Account Center Register Application

You must have an account with Fortiva in order to get the credit card offers by Mail. To create a Fortiva account quickly, follow the instructions below.

- Open any web browser on your device and go to https://www.myfortiva.com/my-account/account-lookup.

- It would be best if you now were on the official registration of Fortiva credit card. Fill out the form displayed with your last name, the last four digits of your social security number, and your date of birth.

- After filling out the form, scroll to the bottom of the form and click on the blue “Submit” button.

- To finish your account registration, simply follow the rest of the onscreen steps. After completing the registration process, you should receive an email indicating whether you are qualified for the myfortiva credit card.

MyFortiva Card Login Procedure

However, you can use the credit card anywhere Mastercard is accepted for everyday purchases and unexpected expenses. The card comes with lots of outstanding benefits and features. And you can manage it online by logging into online banking. Please follow the below steps to access your MyFortiva account online at MyFortiva.com.

- Open the official website and check if there is any login form on the homepage.

- If there is a login form, then enter your Username and Password and press the Sign-In button to access your account.

- If the My Fortiva login form is unavailable on the homepage, navigate to Account – My account. A login form will appear on the screen (as shown below).

- Now you can access your account with the help of your Username and Password.

Important requirements to perform My Fortiva login

There are some basic things that customers must follow in order for a successful login.

- Please check that you are accessing the official website, and the website must start with HTTPS.

- If you don’t have your Username and Password, then register first and create a unique Username and a strong Password.

- Always use a trusted and secure device to access your account.

- Please ensure that there is a good internet connection.

- Always use the latest and most secure browsers that provide enhanced security services.

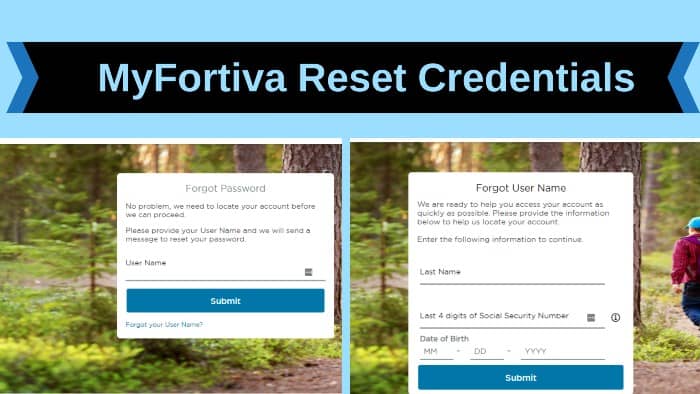

How To Reset My Fortiva Credit Card Credentials?

Step-by-step instructions for resetting the MyFortiva credit card account password & Username:

- The first step is to visit www.MyFortiva.com, click on the “Login” button, and enter your email address or Username in the designated field.

- In case you have forgotten your login credentials, use a backup email address that has been provided by My Fortiva Login as an alternative contact option when signing up for their service; then follow these steps below:

- Go to www.fortivacreditcard.com/forgotpw and type in your customer I.D. (usually found at the bottom of one of your statements), date of birth, last four digits of social security number, and email address used when signing up for the My Fortiva account.

- The last step is to click on “Submit,” answer your security questions, and verify your identity by entering a code that will be sent via email or text message.

You may now log in again with your new credentials!

Apply For MyFortiva Credit Card Online

Only a few simple steps are needed to get your MyFortiva Credit Card. You can follow the guide below, and you will be ready to use your new credit line:

- Start the application process by visiting the official address of MyFortiva Credit Card at www.myfortiva.com.

- There will be a link that says “Respond To A Mail Offer.” You can typically find it on the top part of the web page.

- Examine your mail offer and find the code. Submit the acceptance code on the corresponding field.

- If you can’t find a code on the Mail, it’s usually located near the bottom part of the promotional Mail.

- Below the field, you can click on the “Submit Code.” The My Fortiva Login webpage will show you full instructions, so you can finish your Fortiva Credit Card application.

Remember that you will be required to submit and verify your personal details. One other thing that is important to submit is proof of your annual income to make sure that you will be able to pay your bills.

MyFortiva Activate Online

- https://www.myfortiva.com/my-account/ is the URL for the MyFortiva Credit Card Login Portal.

- On the homepage, select the “Sign In” option.

- Provide your Username and Password in the respective fields.

- Finally, double-check your information and click Sign In.

Pros Of My Fortiva Login

No Security Deposit Required: If you have bad credit, it can be difficult to qualify for a credit card. You are often limited to secured credit cards, which may require you to put up hundreds of dollars as a security deposit. The money you deposit serves as a line of credit. The My Fortiva credit card, on the other hand, is unsecured; H You do not need to make a down payment, even if your credit rating is not ideal. You have a revolving line of credit that you can use for regular transactions as needed.

Access to Credit Score: Once your My Fortiva credit card is approved, you can create an account online. Once your account is open for 60 days, you can view your Vantage Score 3.0 for free. The Vantage 3.0 score differs slightly from the FICO score. Companies commonly use it to determine their credibility, but variables are weighted slightly differently when calculating their score. Your score is between 300 and 850 with a Vantage Score of 3.0; Anything over 700 is generally considered good credit. A credit card’s ability to see your credit score is a common feature. However, a card for people with bad credit is a particularly useful tool. Watch your credit score improve over time by tracking your progress.

Standard Benefits of My Fortiva Account

The MyFortiva credit card has several key advantages that are common in the credit card industry:

- Zero liability in case of fraud

- Payment history reported to three major credit reporting agencies: Equifax, Experian, and TransUnion.

About Fortiva

The MyFortiva credit card is designed for people who are trying to rehabilitate their credit or who have low credit scores that prevent them from getting secured credit cards. However, because you must pay a slew of fees, it is a costly credit card for credit-building.

Having an unsecured credit card like the MyFortiva Mastercard can help you improve your credit score. Because it is solely a credit-building card, it does not offer welcome bonuses, cashback, or any other rewards. There are a number of features you should be aware of with this card.

Improving one’s credit score comes at a price that’s to be expected—but the MyFortiva credit card probably brings a higher price than most would probably expect. The high upfront and ongoing costs (annual fee, monthly maintenance fees, and well-above-average APR) will likely result in an overall cost that’s just as much (if not more) as what one might have paid as collateral for a traditional secured card.

Fortiva Card Payment?

Online payments on the MyFortiva website are fully secured through the 128-bit SSL encryption technology. There are other payment options also available. Please check the below details.

Online payment:

If you have registered an online account, then you can use the online payment facility, which is very fast and secure. Visit the payment section after logging in to your account. Customers can add a payment account such as a saving or checking My Fortiva Account to debit the credit card payment. Customers can use the online payment facility anytime.

Payment through phone:

Customers can also use the phone payment facility to pay their credit card bills quickly. Please call the customer service number and use your savings/checking account or debit card to make a payment.

Payment through Mail:

Customers can use the Mail option to pay their credit card bills. Please use this facility only if at least ten days remain to pay your card bill, as it will take some time to reach the Mail to the payment department.

Payment Processing

P.O. Box 650721

Dallas, TX 75265-0721

Payment through mobile app:

The mobile app also offers a payment facility which is the most convenient way to pay your credit card bill. Just download the mobile app and visit the payment section to pay your card bill, manage your payment, enroll in an automatic payment facility, etc.

Credit Building Card Features

The MyFortiva Mastercard isn’t designed to help cardholders with bad credit, despite being marketed as one. No built-in credit limit increases after a certain number of on-time payments, and no automatic considerations for refunding the security deposit.

In fact, My Fortiva Account does not offer credit limit increases at all – which is easily the most concerning aspect of the card, card fees and all. The only benefit the card can boast is that it reports to all three credit bureaus: Experian, Equifax, and TransUnion.

Depending on the state of your credit at the time of your application, you may be locked into an insignificant credit limit that can’t handle medium-sized purchases—much less add a significant enough credit line to impact your FICO score (a factor that could raise your credit score).

My Fortiva Credit Card Customer Service Phone Number

Get in touch with MyFortiva login if you have any questions or need assistance. On the back of the card, you will find a phone number for customer service. Or visit www.myfortiva.com.

On their website, you will learn about The MyFortiva Credit Card, Fortiva Retail credit payment, and Fortiva Personal Loan products.

| Official Name | My Fortiva |

|---|---|

| Portal Type | Login |

| Languages Supported | English & Spanish |

| Country | USA |

| Sign-In | Required |

Frequently Asked Questions

What is the Rate of Interest for a Fortiva Card?

The APR on the My Fortiva Account credit card may vary from 36% to 38%. Your creditworthiness will affect the interest rate you pay. Even while the MyFortiva Activate card’s goal is to make it easier to develop credit, the high APR makes it difficult to repay your debt.

What can I do with the Fortiva Card login?

To enjoy the Fortiva Credit Card online banking features, you will need to log in to your account. Here are some of the features of online access

- Check your card balance.

- Pay your bills

- Track your transactions

- View your statements and more

- So, if you already have an account, the section under will walk you through it, but if you don’t have the login credentials, you can check the sign-up field.

For who is this MyFortiva card Ideal?

- Have been denied for secured cards from both major and local card issuers

- Have less than $100 disposable income

- Cannot spare cash to use as a secured card security deposit

- Will pay their balance in full every month

- Are looking for a short-term credit card to use to increase their overall credit limit

Last Note

Fortiva Credit card is a card that is specially designed for those who have less credit score, credit score is less than excellent, and are facing the problem of acquiring a credit card from the bank. So we will share what you need and how you can avail yourself of fortivacreditcard com. The Fortiva Mastercard is an unsecured credit card that can help you improve your credit score. It does not give a welcome bonus, cashback, or other sorts of rewards because it is solely a credit-building card. There are several features of this card that you should be aware of.